Benchmarking performance

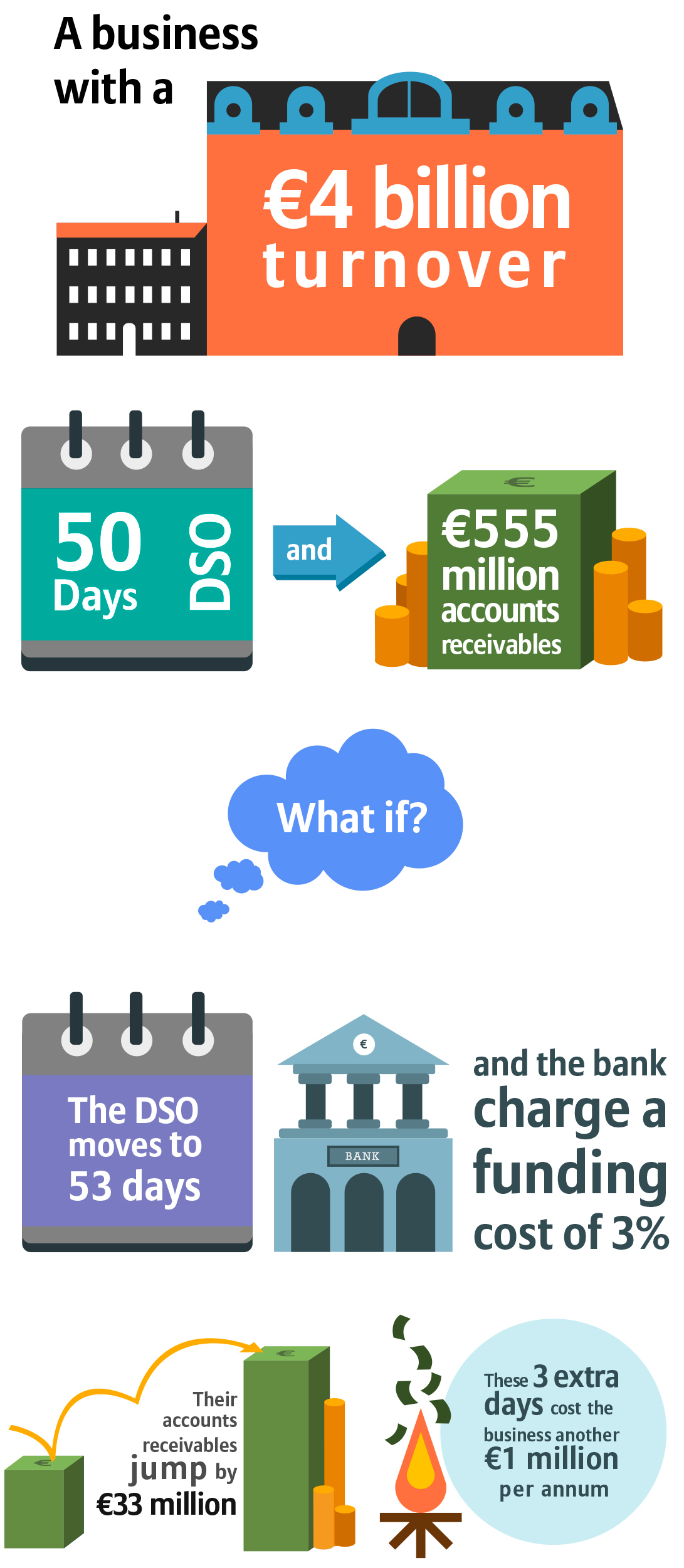

DSO is an essential benchmark of collections performance.

It helps you to better understand and mitigate the risk of new markets, sectors and buyers. But it can also impact external perception of your business.

A business with a low DSO suggests a company whose cashflow is strong, borrowing is under control, and has a professional grasp on its credit and risk management strategies. It allows you to differentiate your business from your peers, and secure your status as a preferred supplier.

A business with a higher DSO, conversely, may be a company that is struggling, whose cashflow is under pressure, and whose borrowing to fund the cashflow 'gap' is a source of concern. If that DSO continues to rise, it could signal a journey from which there is no return.